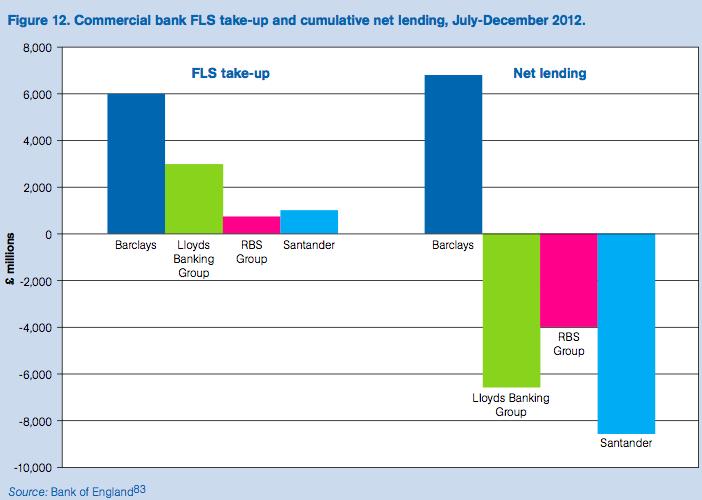

Welcome to SME Alliance: Stepping up to support SME's where our banks and politicians fail...10/6/2014 Today, speaking at the Institute of Directors – George Osborne called upon Businesses to: “raise their heads above the parapet and counter [what he sees as] an anti-free market movement led by trade unions and charities.” Osborne continued: “there is a big argument in our country … about our future, about whether we are a country that is for business, for enterprise, for the free market.” Osborne is right of course, there is a fight for ‘free markets.’ But this fight has nothing to do with unions and charities. It has everything to do with market rigging, monopolism and fraud in the City of London. Upon reading the Osborne headline, I immediately thought back to the 2012 Paralympic games, when an entire stadium booed the Chancellor as he was introduced to the crowd to present the winners medals. People are not stupid. And increasingly, the punter in the street sees through the charade of Westminster spin, forced down the throat of the public by a partisan BBC. I both work for, and volunteer a lot of my time for charities. Most of that time is spent trying to create and foster a new economy. At the heart of this new economy is a financial system that operates in the interests of people and planet, and not just itself. It is not ‘anti-business.’ It is anti-exploitation. From where I sit, this economy of the future is based around supporting small and medium enterprises. The types of businesses that are engrained in local communities, and rich in jobs. The lifeblood of any real economy. Politicians fall over themselves paying lip service to the UK’s 4.9 million SME’s, yet do precious little to represent them, as tax cuts and contracts are dolled out to major corporate donors. When Lawrence Tomlinson - advisor in residence to Biz Innovation and Skills called upon Government to break up State-owned RBS and Lloyds, creating real competition in banking and a level playing field for SME’s, he was personally attacked by politicians, and derided as a ‘businessman with a grievance’ by Chuka Umunna. Tomlinson is right, in Germany 2000 banks compete for 70% of the market, whereas in the UK, the big 5 banks control 90% market share. I met with Lawrence Tomlinson – and I have no doubt that his rationale for demanding a break up of Lloyds and RBS was grounded in the experience of speaking to hundreds of SME’s denied credit or destroyed by the big banks. Instead of reforming and retasking RBS post-bailout, we maintain a zombie, state-owned bank with just 1.4% of net lending reaching the UK manufacturing sector. Throughout my time at Move Your Money, a campaign that encourages people to switch away from the big 5 banks and support small-scale alternatives, I’ve been contacted by dozens of individuals who’s lives have been destroyed by the financial system. Most often, through no fault of their own. The sleeping financial regulators and compliant mainstream media like to describe this activity as “mis-selling.” Most times, its plain vanilla fraud. The people on the receiving end of this fraud, be they individuals “mis-sold” PPI, or SME’s “mis-sold” interest rate hedging products (IRHP) or even businesses “minced” in RBS’ notorious Global Restructuring Group all have personal tales to tell. And yet through the mainstream media, we seldom hear their voices. Typically, these stories involve ongoing inaction by regulators, banks and politicians. Good people, with trust in the system and in our institutions, but who through years of struggle, with no support whatsoever, are left to draw the painful conclusion that there is no-one to fight their corner, but themselves. Often these cases include tales of personal misfortune. A failed marriage, a liquidated business empire, perhaps a repossessed family home. Often it’s impossible to mask the raw emotion in the voices, the hurt, the anger. These people all bear witness to our failed financial system, and it is our job to ensure they are not left isolated and alone. Frequently you hear City Ministers or lobbyists like Anthony Browne of the British Bankers Association repeat the mantra: “banks don’t kill people.” Yet as pointed out by HBOS whistleblower Paul R Moore, the United Nations estimate the 2008/09 bankers crisis drove 100 million people back into poverty around the world, increasing mortality statistics, rates of suicide, and ruining countless lives. In reality, FLS is simply an open cheque for the banks to repair their deficient balance sheets, whilst failing to meet SME lending targets. Another ‘backdoor bailout’ for the banks. Six years after the biggest banking crash in living memory, we are yet to see meaningful bank reform. Banks are still too big to fail, jail, manage or regulate. To date none of the people responsible for this mess have been held accountable. Jails remain conspicuously absent of bank executives, and politicians remain mute. The only conclusion an honest man can draw is that regulators and politicians are negligent, complicit or both. We now live in an era of “deferred prosecution agreements” where it is accepted practice that banks settle fraud cases out of court, and in secrecy. Meaning their sins never see the light of public judgement, paying fines that equate to fractions of illicit profits made. In order to fight back against this financial crime wave in the City of London, we need to be better organised. That means the formation of unlikely alliances, individuals, businesses, campaigners and NGO’s, and those MP’s who care to act. The SME Alliance was forged from a realisation that the institutions set up and maintained over generations to advance the interests of SME’s no longer adequately serve them. Millions of UK citizens are waking up to this same realisation. Many share our same demands. For a society where a corrupt elite, be they bankers, lawyers, politicians or regulators, are no longer above the law. Ferdinand Pecora who led the investigation into the Wall Street crash of 1929 would later remark: "Had there been full disclosure of what was being done in furtherance of these schemes, they could not long have survived the fierce light of publicity and criticism. Legal chincanery and pitch darkness were the banker's stoutest allies." The more things change, the more they stay the same. It’s time for truth and justice. This Weeks Blog Author: Joel Benjamin

Founder Member of SME Alliance

0 Comments

Leave a Reply. |

Archives

November 2021

|

RSS Feed

RSS Feed