For my own situation I go back to 2006 when I wanted to purchase a second Care Home. I approached the Bank, RBS, who approved the loan and in fact they fought hard to secure the deal as there were others interested parties (my relationship manager spoke with the sellers and secured the deal. The previous owner was an ex bank manager). One wanted to turn the property into a school while another would make an offer to purchase both the land and the property. Indeed that remained on the table with the full knowledge of my relationship manager. To make a little more of this point, I could have sold the property for a reasonable profit on day one.

When was I approached regarding the IRHP? When my RM reminded me he had saved my dreams and mentioned IRHP in a passing conversation. Over time I was introduced to the treasury advisor and classified as a private customer see http://www.mondaq.com/x/43030/Financial+Services/Client+Categorisation+FSA+Proposals+For+implementation Without being specific on dates I had a meeting with the RM, The Treasury and an assistant who took minutes. I was asked to sign an FCA document and I was also asked my opinion on Interest Rate Movements at the initial meeting. I did not have a fixed opinion but promised to complete some research via Bloomberg. My research confirmed one facet from the meeting I.e I had not understood the purpose of an IRHP, and I decided I didn’t want or need one. I conferred with the RM who stated I had no choice if I wanted to pursue the purchase. But I had formed my opinion on interest rates based on my reluctance to enter into a product I did not understand. As far as I could see they were going down and I premised this on the sub-prime bust in the U.S.A. which I knew to be a logical argument given that, whatever the USA catches we get a dose. I then formed the opinion of interest Rates of 0% taking into account the Japanese experience of deflation. I had no idea if it was logical commentary but I did not care as I did not want the product. I also informed the advisor that I would cancel out within the 14 day cooling off period. Interestingly, he advised me I couldn’t. Why was I so afraid of the product? You tell me? After what I'd been told I came away believing that it would protect me from rising rates, yet I would benefit from falling. I could sell the product and make money? It would not impede on my borrowing and I could move it to another bank. A super product which I did not trust. Yes of Course I now know that those terms related to differing types of products. OCT 2007 I completed the purchase and entered into the hedge. Why have I titled this post as a perfect Storm? Again I revisit my own experiences. 1st payment to the swap 02/01/2008 was £255.17 per quarter but by October 2009 that payment, as interest rates fell away, became £10,722.37. The RM then approached me with a new mortgage, a LIBOR Loan, in a scenario best explained by using his words “you scratch your bank we scratch yours.” I was still too trusting. I re-mortgaged and novated the swap, both to LIBOR. The swap payments moved between £3010 pcm to a high of £4010pcm Whilst all this was going on for me we had the Market crash and an election in May 2010. The Tories and the Lib Dems united and a few short weeks later we had the austerity budget. While this did little to the care industry directly, the council budgets were, let’s just say, pared back. The first significant event I had was a letter from one of the London councils asking for a reduction in fee levels for one service user. To date that same council has not raised fee levels since. Another council despite all of its clients having been approved via their own fair pricing tool, sought to reduce their fees. This happened in 2012 – 2013 and it personally hit my business by £3,000 per month. I know of one area of the UK Nursing homes which were paid in arrears instead of the usual practice of 2 weeks advance 2 weeks in arrears. Many homes have not been offered fee increases during this time frame and despite contracts being effectively written for cost of living increases. Domiciliary Care contracts in some areas have gone from £17 per hour to £12 per hour. Other councils have started the terrible situation of bidding for service users and usually the lowest price wins. I have heard of care hours being bid for under £10 per hour. Just look at that for a moment - Living wage outside of London £7.65 (per hour?), London £8.80, fuel costs, back office, training, PAYE, pension? Again going back to the time frame 2010 – today we have seen a rise in the cost of living, food, heating, fuel. Business wise we have seen increases in the minimum wage, the introduction of pension schemes (great news) hopefully the introduction of the living wage. At one fee meeting arranged by a local care association, within the aforementioned time period, I mentioned the living wage knowing full well that the council had a policy of paying the living wage. When I asked if that living wage was reflected in the pricing tools for care, there was silence in the room. Now I am unsure if it is accounted for, as I do not have access to their modern pricing tool but if the silence was to be the judge I really do not think it was thought of or genuinely they did not know the answer at that time. Now go back to that Care business which has the IRHP. It's not benefiting from falling interest rates and it's income is being squeezed. The costs are going through the roof and what will suffer? You could reduce staffing - I had a minimum staffing requirement negotiated through individual contracts with clients, so no go for me although possibly others could reduce staff. Another major cost is maintenance and many operators I have spoken to have cut back. This means the homes look tired. Then the CQC inspector looks at it and puts conditions on you – you have to maintain the property and if you fail some authorities restrict/stop placements. Then there's cash flow management, you don’t pay the electricity bill or the gas bill. I've heard of homes who do this being reported straight to CQC. The pressure on numerous businesses across all sectors is immense but in Care it’s the vulnerable who suffer and not just the business. How did I cope? By borrowing from HMRC and utilising their time to pay arrangement. As a side issue, how big is the problem within care? Without spending fortunes or hours on research I investigated via the phone and email and this is what I discovered. I have taken everyone I spoke to on trust as they had nothing to gain by exaggerating I am talking about pure care home sales on the open market at the peak. I am not speaking about corporate sales and, after speaking to a number of agencies, from the smallest to some of the largest, the average guestimate was of 300 sales per annum, from 2006 – 2010. So in just 5 years, 1500 care homes have been put at risk from these products. This figure of course covers just sales not re financing, refurbishments, new builds, extensions etc etc. How many vulnerable people within those care homes? How many staff? How many families have been affected? Another guide given was from a specialised broker fighting against IRHP’s. He had 34 care groups fighting mis selling of IRHPs with a total of 150 care homes at risk! A final thought - if we in the Care Industry are found to have committed a financial irregularity against a service user, it is rightly considered to be abuse. Staff members could lose their jobs as it is deemed to be gross misconduct and the business could lose its registration. Yet when financial abuse is committed against the owners and operators of care businesses by the banks what is done? Seemingly a long drawn out redress scheme and a slap on the wrist. Examples of this - IRHP FX LIBOR.

2 Comments

What does that tell us ? Perhaps that if a few like minded people have an idea and a group around them, equally like minded and committed to that idea which they all believe will become something extraordinary , and they don't just talk about it , but do it ...then that idea can come into existence .

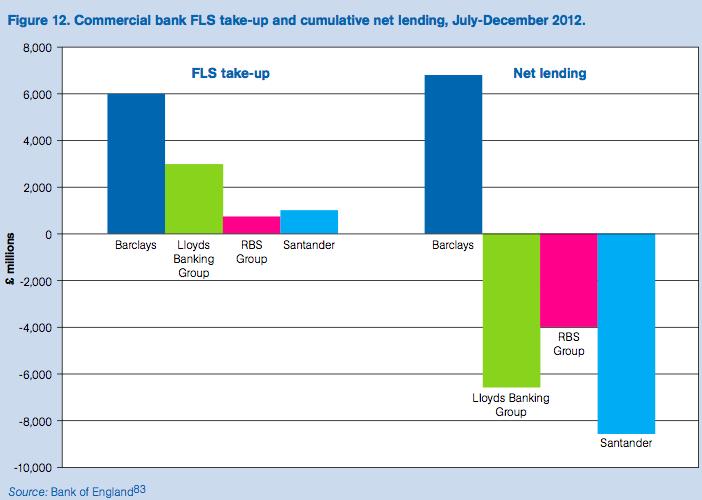

From what I know not only of Nikki but also about the other core members of the SMEalliance, they all hold very strong views about many things. Mostly at the moment about the behavior of the UKs major banks and more importantly the holding to account of those who run and who ran them. Many of these members have every right to those views -- watch this space for more . We know there are other groups who are involved actively in this appalling saga. We intend to push the debate to a much higher level. We want MPs, regulators and senior management of the banks themselves to understand this is not going to go away. As one well known Prime Minister said " we're all in this together". But we're not really, are we?We need actions to replace not only unacceptably delays but what can only be described as a disgraceful lack of understanding /compassion ( a word unknown to too many these days ) by those who ought to know better.The genuine sense of injustice and inability to access the law for redress felt by many ought to be resolved by the famous quotation from Theodore Roosevelt which we intend to make one of our core objectives. Roosevelt said "No-one is above the law." At the moment (very sadly) it has been better defined by Professor Richard Moorhead -- of the Centre for of Ethics and Law at University College Law School as "No one is above the law but some are not above it more than others " ( think about it). But the SME alliance is absolutely not, not just about the banks. It might be about so many other matters you all know about but don't ever seem to begin to get fixed. For example , the inability to raise finance , the amount of irrelevant red-tape stopping business growth ; the idea of a " Smaller Companies Companies Act"; a way of breaking down the huge blocks / silos between difference groups , such as the SMEs themselves, academics, Westminster /Whitehall and professional advisors. After all, it all seems to work much better at the level of the FTSE companies, why not here ? We understand we can't currently solve any of these and other problems encountered by so many SMEs. Nor are we arrogant enough to say otherwise. However ,SMEs make up a vast constituency in the UK. You may know the figures . Some 99% of all companies are SMEs. They employ together over 24 million people and contribute more than £1,500 billion, to the UK economy. There should be a much greater effective voice for those companies somewhere. Maybe you , too, can be part of that voice. Welcome to SME Alliance: Stepping up to support SME's where our banks and politicians fail...10/6/2014 Today, speaking at the Institute of Directors – George Osborne called upon Businesses to: “raise their heads above the parapet and counter [what he sees as] an anti-free market movement led by trade unions and charities.” Osborne continued: “there is a big argument in our country … about our future, about whether we are a country that is for business, for enterprise, for the free market.” Osborne is right of course, there is a fight for ‘free markets.’ But this fight has nothing to do with unions and charities. It has everything to do with market rigging, monopolism and fraud in the City of London. Upon reading the Osborne headline, I immediately thought back to the 2012 Paralympic games, when an entire stadium booed the Chancellor as he was introduced to the crowd to present the winners medals. People are not stupid. And increasingly, the punter in the street sees through the charade of Westminster spin, forced down the throat of the public by a partisan BBC. I both work for, and volunteer a lot of my time for charities. Most of that time is spent trying to create and foster a new economy. At the heart of this new economy is a financial system that operates in the interests of people and planet, and not just itself. It is not ‘anti-business.’ It is anti-exploitation. From where I sit, this economy of the future is based around supporting small and medium enterprises. The types of businesses that are engrained in local communities, and rich in jobs. The lifeblood of any real economy. Politicians fall over themselves paying lip service to the UK’s 4.9 million SME’s, yet do precious little to represent them, as tax cuts and contracts are dolled out to major corporate donors. When Lawrence Tomlinson - advisor in residence to Biz Innovation and Skills called upon Government to break up State-owned RBS and Lloyds, creating real competition in banking and a level playing field for SME’s, he was personally attacked by politicians, and derided as a ‘businessman with a grievance’ by Chuka Umunna. Tomlinson is right, in Germany 2000 banks compete for 70% of the market, whereas in the UK, the big 5 banks control 90% market share. I met with Lawrence Tomlinson – and I have no doubt that his rationale for demanding a break up of Lloyds and RBS was grounded in the experience of speaking to hundreds of SME’s denied credit or destroyed by the big banks. Instead of reforming and retasking RBS post-bailout, we maintain a zombie, state-owned bank with just 1.4% of net lending reaching the UK manufacturing sector. Throughout my time at Move Your Money, a campaign that encourages people to switch away from the big 5 banks and support small-scale alternatives, I’ve been contacted by dozens of individuals who’s lives have been destroyed by the financial system. Most often, through no fault of their own. The sleeping financial regulators and compliant mainstream media like to describe this activity as “mis-selling.” Most times, its plain vanilla fraud. The people on the receiving end of this fraud, be they individuals “mis-sold” PPI, or SME’s “mis-sold” interest rate hedging products (IRHP) or even businesses “minced” in RBS’ notorious Global Restructuring Group all have personal tales to tell. And yet through the mainstream media, we seldom hear their voices. Typically, these stories involve ongoing inaction by regulators, banks and politicians. Good people, with trust in the system and in our institutions, but who through years of struggle, with no support whatsoever, are left to draw the painful conclusion that there is no-one to fight their corner, but themselves. Often these cases include tales of personal misfortune. A failed marriage, a liquidated business empire, perhaps a repossessed family home. Often it’s impossible to mask the raw emotion in the voices, the hurt, the anger. These people all bear witness to our failed financial system, and it is our job to ensure they are not left isolated and alone. Frequently you hear City Ministers or lobbyists like Anthony Browne of the British Bankers Association repeat the mantra: “banks don’t kill people.” Yet as pointed out by HBOS whistleblower Paul R Moore, the United Nations estimate the 2008/09 bankers crisis drove 100 million people back into poverty around the world, increasing mortality statistics, rates of suicide, and ruining countless lives. In reality, FLS is simply an open cheque for the banks to repair their deficient balance sheets, whilst failing to meet SME lending targets. Another ‘backdoor bailout’ for the banks. Six years after the biggest banking crash in living memory, we are yet to see meaningful bank reform. Banks are still too big to fail, jail, manage or regulate. To date none of the people responsible for this mess have been held accountable. Jails remain conspicuously absent of bank executives, and politicians remain mute. The only conclusion an honest man can draw is that regulators and politicians are negligent, complicit or both. We now live in an era of “deferred prosecution agreements” where it is accepted practice that banks settle fraud cases out of court, and in secrecy. Meaning their sins never see the light of public judgement, paying fines that equate to fractions of illicit profits made. In order to fight back against this financial crime wave in the City of London, we need to be better organised. That means the formation of unlikely alliances, individuals, businesses, campaigners and NGO’s, and those MP’s who care to act. The SME Alliance was forged from a realisation that the institutions set up and maintained over generations to advance the interests of SME’s no longer adequately serve them. Millions of UK citizens are waking up to this same realisation. Many share our same demands. For a society where a corrupt elite, be they bankers, lawyers, politicians or regulators, are no longer above the law. Ferdinand Pecora who led the investigation into the Wall Street crash of 1929 would later remark: "Had there been full disclosure of what was being done in furtherance of these schemes, they could not long have survived the fierce light of publicity and criticism. Legal chincanery and pitch darkness were the banker's stoutest allies." The more things change, the more they stay the same. It’s time for truth and justice. This Weeks Blog Author: Joel Benjamin

Founder Member of SME Alliance |

Archives

November 2021

|

RSS Feed

RSS Feed